A bank statement converter to Excel is a specialized tool that pulls all your transaction data out of a PDF or image and neatly organizes it into a spreadsheet. It’s the difference between spending hours hunched over a keyboard and getting the job done in minutes.

Moving Beyond Manual Bank Statement Entry

If you’ve ever had to manually type transactions from a bank statement into a spreadsheet, you know it’s not just tedious—it's a massive time sink. For anyone in finance, bookkeeping, or running a small business, this kind of repetitive work is a major roadblock to getting more important things done, like analyzing the numbers instead of just copying them.

The costs buried in this old-school process are surprisingly high. Imagine a finance team handling just 50 statements a month. That manual effort can easily add up to 150-200 hours a year spent on just getting data from point A to point B. If you put a dollar figure on that, it could be anywhere from $6,000 to $12,000 annually in labor costs for what is essentially glorified typing.

The True Cost of Human Error

It’s not just about the time and money, either. Manual data entry is a breeding ground for mistakes. A single typo, a transposed number, or a missed transaction can create a ripple effect of problems down the line.

Suddenly you’re dealing with:

- Messed-up Reconciliations: Wasting hours trying to find that one tiny error that's throwing off the entire month.

- Inaccurate Financial Reports: Making business decisions based on faulty data, which is a recipe for disaster.

- Compliance Headaches: Errors found during an audit can lead to fines and a hit to your company's credibility.

The typical human error rate for this kind of work hovers between 1% and 4%. That might not sound like much, but when you're dealing with thousands of transactions, it guarantees that mistakes will happen. While newer systems like PSD2 banking integration are changing the game for live data, you still need a solid converter for all the static PDF statements.

To put it in perspective, here's a quick breakdown of what you're up against.

Manual Entry vs Automated Converter: A Time and Cost Snapshot

This table shows just how stark the difference is between the old way and the new way.

| Metric | Manual Data Entry | Automated Converter |

|---|---|---|

| Time per Statement | 30–60 minutes | < 1 minute |

| Error Rate | 1% - 4% | < 0.1% |

| Annual Cost (50 statements/mo) | $6,000 - $12,000+ | Low monthly subscription fee |

| Staff Focus | Low-value transcription | High-value analysis & strategy |

The numbers speak for themselves. The automated approach isn't just a marginal improvement; it's a fundamental shift in efficiency.

The core problem with manual entry is that you are paying skilled professionals to perform a task that a machine can do faster, cheaper, and with greater accuracy. The goal is to free up human talent for high-value analysis, not data transcription.

This is why switching to a bank statement converter to Excel is such a no-brainer. It’s a simple change that stops the bleeding of time and money, eliminates frustrating errors, and lets you focus on what actually matters—understanding the financial story your data is telling.

Decoding Different Bank Statement Formats

Not all bank statements are created equal. Before you even think about converting a bank statement to Excel, you have to know what you’re working with. The type of file you have dictates your entire approach, and getting this part right from the start will save you a world of frustration.

You’ll typically run into one of three formats, and each brings its own set of challenges to the table.

The Good, The Bad, and The Scanned

Let's break down the common file types you'll encounter, which range from a simple data dump to a genuine conversion headache.

Digitally Native PDFs: These are the gold standard. When a bank generates a PDF directly from its system, it contains real, selectable text. A good converter can read this data directly, making the process quick and nearly 100% accurate. It’s the best-case scenario.

Scanned PDFs or Images (JPG/PNG): This is where things get tricky. These files are basically just pictures of a paper statement. There’s no text data for a program to read—only pixels. To pull any information out, you’ll need a tool equipped with Optical Character Recognition (OCR) to "read" the image and translate it into usable text.

CSV Files: If you can get your data in a CSV file directly from your online banking portal, you’ve hit the jackpot. This is a simple, comma-separated text file that Excel can open perfectly without any conversion needed. You're already done.

This variety is exactly why the market for document data capture is exploding. Specialist providers of bank statement converters often support over 500-600+ banks worldwide. Why so many? Because every bank has a unique layout, and the software needs sophisticated logic to handle all those variations. You can dive deeper into this trend in this overview of AI-powered financial tools.

Common Layout and Data Challenges

Even if you have a perfect digital PDF, the statement's layout can throw a wrench in the works. Banks design statements for people to read, not for computers to parse, which often creates a mess during conversion.

I’ve seen all sorts of quirky layouts that cause problems:

- Multi-Column Transactions: Some banks put debits and credits in separate columns. Others use a single column with positive and negative values. A rigid tool will fail here.

- Inconsistent Date Formats: Does "01-02-2024" mean January 2nd or February 1st? This ambiguity is a classic headache that can wreck your reconciliation if not handled properly.

- Multi-Line Descriptions: A single transaction description can easily spill over into two or three lines. A basic converter will often misinterpret this and split one transaction into multiple, incorrect rows in your spreadsheet.

The core challenge is that there’s no universal standard for bank statement layouts. A good converter has to be smart enough to adapt to different column structures, date conventions, and formatting quirks from one bank to the next.

On a related note, if you’re working with a massive PDF that bundles statements for multiple months or accounts, you’ll want to split it up first. Our guide on how to separate PDF pages shows you how to easily isolate just the pages you need. This simple prep step keeps your final Excel file clean and focused on the right data.

Knowing these potential roadblocks ahead of time helps you pick the right tool and configure it correctly from the get-go.

A Secure Workflow Using an Offline Converter

When you're dealing with financial data, security isn't just a feature—it's everything. The thought of uploading sensitive bank statements to some random website is enough to make anyone nervous, and for good reason. This is exactly why offline, browser-based tools have become so valuable; they give you a secure, controlled space to convert your files.

A secure bank statement to Excel converter, like the one from Digital ToolPad, runs entirely on your local machine. Nothing ever gets sent over the internet. Your private financial documents are never uploaded to a server or seen by anyone else. The whole process, from scanning the text to pulling out the data, happens right inside your web browser.

This "client-side" approach gives you a massive security advantage. You get all the convenience of a simple web tool without any of the risks that come with cloud processing. It’s a workflow you can actually trust, whether you're a freelancer sorting your own books or a financial analyst handling confidential client data.

Getting Started with an Offline Conversion

The best part is how simple and fast this is. You don't have to install any clunky software or sign up for an account. Just go to the tool's webpage, and you're good to go. The first thing you'll do is pick your bank statement file, which can be a digital PDF, a scanned copy, or even a simple image file.

As you can see, the tool is built around a simple drag-and-drop area. This design makes it incredibly intuitive. You just upload your statement and get right to work without fumbling through confusing menus.

Once your file is loaded, the tool gets to work. If it senses a scanned document, it automatically kicks on the OCR to turn the picture of text into real, machine-readable characters. This is what makes it possible to actually extract the transaction data.

Visually Mapping Your Statement Data

This is where a truly great converter proves its worth. Every bank has its own unique statement layout, so a rigid, one-size-fits-all template is bound to fail. A flexible tool lets you visually map the data columns yourself, which guarantees accuracy no matter what the format looks like.

Here’s a look at how it generally works:

- Pick a Page: If your statement is multiple pages long, you can select the one you want to use as your template.

- Draw Selection Boxes: The tool will show you an image of your statement. From there, you just draw a box around the key columns—like Date, Description, Debits, and Credits.

- See a Live Preview: As you map each column, a preview table fills up with the extracted data in real-time. This instant feedback is fantastic because you can confirm everything is being captured correctly before you download a thing.

This visual mapping process is an absolute game-changer for dealing with weird or non-standard layouts. It puts you in the driver's seat, letting you tell the software exactly where to find each piece of information.

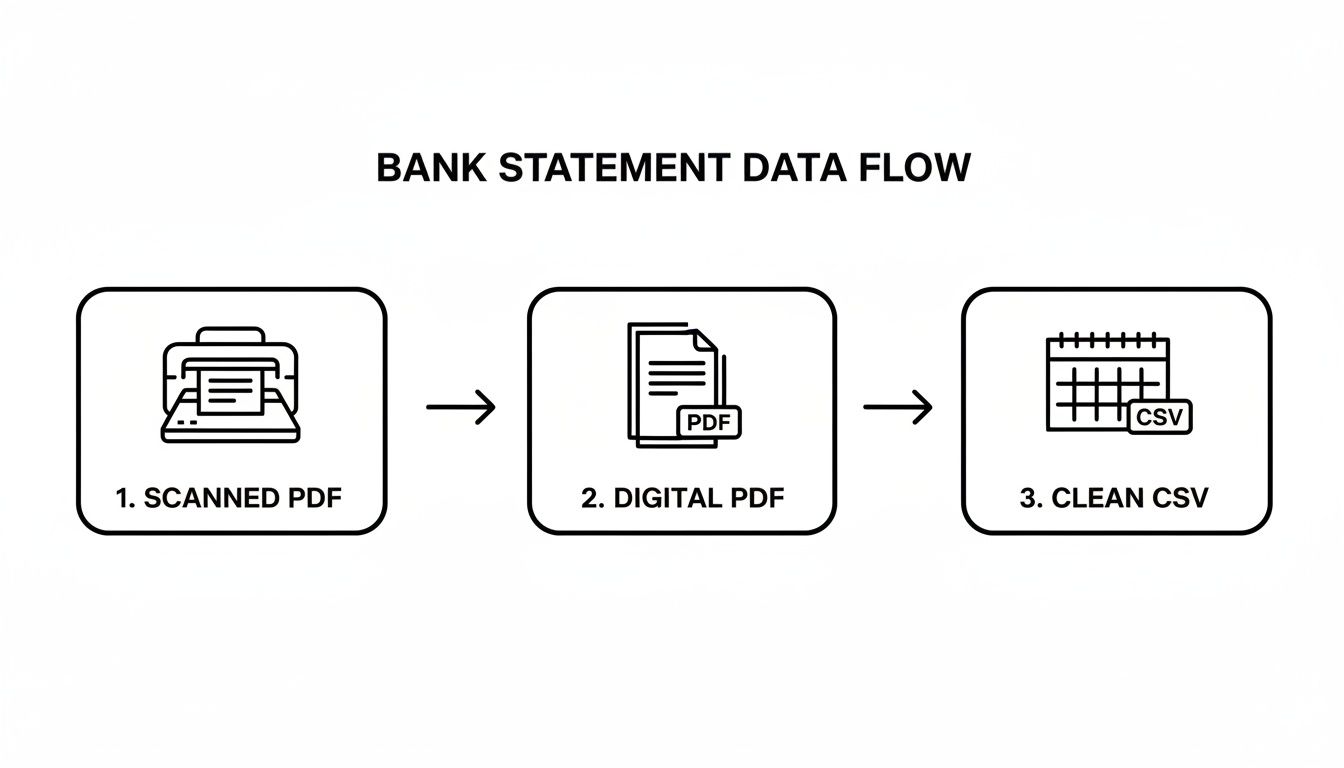

The following diagram shows the journey your document takes, starting as a messy scan and ending up as a clean, structured spreadsheet.

Key Takeaway: The ability to visually map data columns is the most critical feature for ensuring accuracy. It allows the tool to adapt to your specific bank statement instead of forcing your statement to fit a rigid template.

Finally, with your data mapped and looking good in the preview, you can export it. One click downloads a perfectly formatted Excel or CSV file right to your computer. It’s now ready for analysis, reconciliation, or to be imported into your accounting software. The entire workflow, from upload to download, takes just a few minutes and keeps your sensitive data safely offline the whole time.

Polishing and Validating Your Data in Excel

Getting your transaction data into a spreadsheet is a huge win, but the job isn't quite done. The raw data from a converter is a great starting point, but it almost always needs a final polish to be genuinely useful for accounting or analysis.

Think of this next phase as your quality control checkpoint.

This is where you'll clean up pesky inconsistencies, double-check the numbers, and structure the information so it’s ready for whatever you need, whether that's personal budgeting, tax prep, or a full-blown financial audit.

Standardizing Your Data for Consistency

The first thing you'll probably run into is inconsistency. OCR and automated tools are good, but minor variations love to sneak through, especially in dates and text fields.

For example, your date column might be a jumble of formats like "Jan 5, 2024," "01/05/24," and "2024-01-05." The fix is easy: just select the entire column, right-click, choose Format Cells, and pick one consistent date format. This simple action ensures you can sort and filter your transactions chronologically without a hitch.

Another common headache is messy transaction descriptions. A single cell might contain the vendor, location, and payment type all jammed together. Excel’s Text to Columns feature (found under the Data tab) is your best friend here. It lets you split that jumbled text into separate, clean columns based on spaces, commas, or other dividers. This makes categorizing your expenses infinitely easier down the line. If you're dealing with more complex data structures, our guide on converting JSON data into clean CSV formats touches on similar principles that you might find helpful.

Finding and Fixing Errors

With your data formatted neatly, it's time to hunt for errors. Even with a high-quality conversion, mistakes can happen. The goal is to catch them before they snowball into bigger problems.

A simple yet incredibly powerful tool for this is Conditional Formatting. You can create rules that automatically flag potential issues for you.

- Flag Incorrect Values: Set a rule to highlight any negative numbers in your "Debit" or "Withdrawal" column, as these should almost always be positive.

- Identify Outliers: Make large transactions (say, anything over $1,000) stand out with a different color so you can give them a second look.

- Spot Duplicates: Use the built-in duplicate values rule to highlight entire rows that are identical. It’s a lifesaver if you accidentally process a statement twice.

My Pro Tip: Sanity checking your totals is non-negotiable. Use the

SUM()function to add up your debit and credit columns. Then, grab your original bank statement and compare those totals to the summary section. If the numbers don't match, you know there's a discrepancy hiding somewhere that needs to be found.

Once you’ve converted and scrubbed your bank statement data, the last crucial step is understanding the importance of bank reconciliations. This process, where you match the clean Excel data against your own books, is the final check that guarantees everything is accounted for. Taking a few extra minutes for these validation steps transforms raw data into a reliable financial record you can actually trust.

Why Privacy-First Offline Tools Are a Smarter Choice

When you're dealing with bank statements, security isn't just a nice-to-have feature; it’s everything. Think about it—these documents are packed with account numbers, transaction histories, and personal details. The very idea of uploading that to some random website's cloud server should make you pause.

This is where the difference between online and offline tools really matters. A privacy-first bank statement converter to Excel does all its work right inside your browser. Nothing ever leaves your computer. Because the conversion happens locally, your sensitive information is never sent over the internet or stored on a third-party server. You stay in complete control, from start to finish.

The Problem with Cloud-Based Converters

Many free online tools seem great until you consider the hidden cost: your data. When you upload a file to a cloud service, you’re essentially handing over control. You're trusting that company to have perfect security, to not misuse or sell your data, and to never, ever get breached. That’s a lot of trust to place in a stranger.

For any business, this is more than just a risk; it's a massive compliance headache. Regulations like GDPR have strict rules about handling personally identifiable information. Using a cloud tool without a thorough security vetting process can open you up to serious legal and financial trouble. For many organizations, this makes offline solutions the only realistic option.

The bottom line is that your financial data should never leave an environment you control. An offline, browser-based tool is the simplest and most effective way to achieve this, cutting out external risks entirely.

This is especially true in heavily regulated sectors. In the EU, financial and healthcare organizations can't just send personal data to external processors without putting serious safeguards in place. When you consider that a single year of statements for 1,000 customers can easily contain over a million individual transactions, the scale of the risk becomes clear. Offline tools sidestep this problem completely, ensuring the raw PDFs and the final Excel files never leave your device. You can dig deeper into these data privacy considerations for financial insights.

The Advantages of an Offline Workflow

Going with an offline converter isn't just about dodging risks. It also brings some practical perks that make your work easier and give you peace of mind.

Here’s why it’s the smarter way to go:

- Zero Data Exposure: The biggest win. Your files are never uploaded, which eliminates the threat of server-side data breaches or prying eyes.

- Instant Processing: Everything runs on your machine, so you aren't at the mercy of network speeds. Conversions are fast and immediate, with no waiting around for uploads or downloads.

- Simplified Compliance: Using a tool that processes data locally makes it far easier to stay compliant with privacy laws like GDPR and CCPA.

- Works Anywhere: As long as you have a browser, you're good to go. It works perfectly even if your internet is slow, spotty, or completely offline.

This "secure-by-design" approach is the same principle behind other privacy-focused tools. For example, our guide on creating a secure offline QR code generator follows the same logic—get the job done without sending sensitive information across the web. At the end of the day, an offline bank statement converter gives you the powerful functionality you need without asking you to compromise on the security of your most confidential data.

Common Questions About Bank Statement Converters

Even with the best tools, you’ll likely have questions when you start converting financial documents. It's easy to get tripped up by different file types, security concerns, or just plain quirky statement layouts. Let's walk through some of the most common hurdles people hit when using a bank statement converter for Excel.

Think of this as the "what if" guide. I'll give you straightforward, practical answers to help you get clean, accurate data every single time.

Can a Converter Handle Scanned or Low-Quality PDFs?

Yes, but it's a classic "garbage in, garbage out" situation. A modern bank statement converter to Excel leans heavily on Optical Character Recognition (OCR) to read text from an image. It's literally turning a picture of your statement into usable data.

For the best results, you need a clean scan. That means high-resolution, good lighting, no heavy shadows, and please, make sure it’s straight! The better the image quality you feed the tool, the more accurate the data you’ll get back.

A secure, browser-based tool is perfect for this. It runs the OCR process locally on your machine, so even your scanned statements—which are packed with sensitive info—never get uploaded to some random server.

Is It Really Safe to Use an Online Bank Statement Converter?

This is probably the most important question you can ask, and the answer hinges entirely on how the tool is built. Many online converters make you upload your bank statements to their servers to be processed. That's a huge red flag. It creates a massive security hole, sending your private financial data out of your control.

A privacy-focused tool works completely differently. It performs all the conversion magic 100% offline, right in your browser. Your data never leaves your computer, which eliminates the risk of a server-side data breach. This is hands-down the safest way to handle your documents and stay compliant with data privacy rules.

What if My Bank Statement Has a Weird Column Layout?

Don't worry, you're not alone. Funky layouts are incredibly common because there's absolutely no standard format for bank statements. A basic, run-of-the-mill converter will likely choke on them, but a more flexible tool is designed for exactly this kind of mess.

The feature you want to look for is visual mapping. This lets you literally draw boxes around the key data columns—date, description, debits, credits—right on top of your statement's image. You're essentially teaching the tool where to look, which guarantees a perfect data extraction no matter how unconventional the layout is.

What’s the Fastest Way to Convert a Whole Stack of Statements?

When you’re staring down a pile of statements, efficiency is everything. This is where a browser-based offline tool truly shines, because it boils the whole workflow down into a few simple actions.

The process is incredibly fast:

- You open the tool's webpage.

- Drag and drop your first statement.

- Map the columns just once for that bank's specific format.

- Instantly download the clean Excel file.

From there, you just repeat the drag-and-drop process for the rest of your files. A task that used to eat up hours of mind-numbing manual entry can be knocked out in just a few minutes. It turns a nightmare of a job into something quick and painless.

Ready to convert your bank statements with total security and speed? The Digital ToolPad suite offers a powerful, offline bank statement converter that runs entirely in your browser, keeping your financial data private. Try it now at https://www.digitaltoolpad.com and turn your PDFs into analysis-ready Excel files in minutes.