A bank statement converter is a deceptively simple tool with a critical job: taking messy PDF or CSV files and turning them into clean, usable formats like Excel or JSON. For anyone who deals with sensitive financial data—especially developers and security-focused teams—one feature stands above all else: the ability to do this work entirely offline.

Your financial data should never touch a server you don't control. Period.

Why Offline Is the Only Option for Financial Data

Let's be blunt: uploading a bank statement to a random cloud-based AI tool is a massive security risk. Every time you send a file to a third-party server, you're creating a new attack surface. You're trusting that their security is flawless, that no rogue employee has access, and that they comply with every single data regulation like GDPR. That’s a lot of trust to place in a stranger.

This is exactly why smart teams are pulling back from cloud-based tools for this kind of work. An offline, browser-based bank statement converter sidesteps these risks by design. The entire conversion process happens right on your machine, inside your browser's sandbox. Nothing gets transmitted, nothing gets stored on an external server, and nothing leaves your control.

Here's a quick breakdown of how these two approaches stack up.

Offline vs Cloud-Based Converters: A Security and Performance Comparison

| Feature | Digital ToolPad (Offline) | Cloud-Based AI Tools |

|---|---|---|

| Data Privacy | Stays on your local machine. No external transmission. | Uploaded to third-party servers, creating data exposure risks. |

| Accuracy | 100% deterministic. Same input always yields same output. | Prone to AI "hallucinations," misinterpretations, and errors. |

| Speed | Instantaneous. No network lag or upload/download delays. | Slowed by network latency and server processing queues. |

| Accessibility | Works anywhere, even without an internet connection. | Requires a stable internet connection to function. |

| Cost | Typically a one-time purchase or free with limits. Predictable. | Often subscription-based, with costs scaling on volume. |

| Compliance | Simplifies compliance (GDPR, CCPA) by keeping data local. | Creates complex compliance obligations and data residency issues. |

The choice becomes pretty clear when you see it laid out like this. For serious financial work, the local-first approach is the only one that guarantees both security and reliability.

The Deterministic Edge: Why Predictability Beats AI Here

Beyond the security concerns, there's the problem of consistency. AI-powered tools can be fickle. I’ve seen them misread dates, invent transaction details, or just randomly change formatting between runs. This "black box" behavior is a dealbreaker for any workflow that depends on 100% accuracy.

An offline, deterministic tool is different. It’s built on a concrete set of rules. It parses data the same way, every single time, giving you predictable, repeatable results. When you're building automated scripts or preparing for a financial audit, that kind of rock-solid consistency is non-negotiable.

Look, if you’re a developer building a fintech app or a team managing company books, you need to be in the driver's seat. An offline converter gives you that control. You're not gambling on a third-party's security or an AI's mood.

This isn't just a niche concern. The market for these tools is booming. The global Bank Statement Analyzer market is on track to grow from $2.3 billion in 2025 to $4.1 billion by 2033, largely because businesses are demanding more reliable and secure ways to handle their data.

The Clear Wins of a Local-First Approach

When you commit to handling conversions locally, the benefits are immediate and practical.

- You Own Your Data: It’s that simple. Your financial records stay on your hardware, under your control. This is huge for meeting data residency rules and your own internal security standards.

- Zero Lag, Instant Results: No waiting for uploads or downloads. Conversions happen in a blink, which is a lifesaver when you're processing a whole year's worth of statements.

- It Just Works—Anywhere: On a plane? In a coffee shop with spotty Wi-Fi? No problem. The tool is always available because it doesn't need the internet to run.

- Strengthens Your Security Posture: Keeping sensitive data offline is a foundational security practice. It complements other skills, like knowing how to decrypt encrypted text, by fostering a security-first mindset across all your work.

Preparing Your Statements for a Flawless Conversion

The old saying "garbage in, garbage out" has never been more true than when converting bank statements. Before you even touch a conversion tool, spending just a few minutes prepping your files can be the difference between a clean, perfect export and hours of manual clean-up. Trust me, it’s the digital equivalent of "measure twice, cut once."

I’ve seen it all—bank-generated documents are notoriously inconsistent. One month you get a clean, text-based PDF, and the next, it’s a blurry scanned image with a completely different date format. This is precisely where most automated conversion processes trip up.

Handling Common File Issues

First things first, you need to know what you’re working with. Financial institutions have a knack for exporting statements in formats that are a headache for automated tools. Here are the most common hurdles I see and how to get past them:

- Password-Protected PDFs: Banks often lock down statements for security, which is great, but it means a converter can't open them. You’ll have to open the PDF with your password first, then save a new, unprotected copy before you can process it.

- Scanned (Image-Based) Statements: Is your PDF just a picture of a paper statement? If you can't click and highlight the text, the converter can't read it either. You'll need an external Optical Character Recognition (OCR) tool to turn that image into readable text first.

- Complex Multi-Page Layouts: Some statements are monsters—dozens of pages with changing headers, footers, and summary sections. If you're batch processing, it’s much cleaner to isolate only the pages with actual transactions. For developers digging into large datasets, getting good at text extraction is non-negotiable. The guide, Mastering Python PDF Text Extraction, is a fantastic place to start.

Dealing with one giant PDF that has multiple monthly statements rolled into one? It's far better to split it up first. You can learn exactly how to do that in our guide on how to separate PDF pages.

Standardizing Your Data Before Conversion

Once your files are actually readable, the next hurdle is standardization. Banks have their own unique ways of formatting everything from dates (MM/DD/YYYY vs. DD-Mon-YY) to currency symbols and transaction descriptions. A little pre-processing here will save you a world of pain.

If you have a CSV, pop it open in a spreadsheet program for a quick sanity check. Get rid of any junk rows—promotional text, account summaries, weird headers or footers—that can throw off the parser. You want a clean file with just the column headers and the transaction data.

Pro Tip: Always, and I mean always, make a backup of your original bank statement files before you start editing. This gives you a clean slate to return to if something goes wrong or you need to start over. It's a simple step that has saved me countless times.

Also, keep an eye out for merged cells or wonky column structures, which are surprisingly common in exported reports. Make sure every single row represents one transaction and each column holds a specific type of data (Date, Description, Debit, Credit). Taking a minute to validate this ensures the converter can map everything perfectly, giving you an error-free result every single time.

Putting Secure, Offline Bank Statement Conversion into Practice

Alright, let's move from the 'why' to the 'how.' I’ll walk you through the actual steps of using a secure, offline bank statement converter on your own machine. The real beauty of a browser-based tool like this is its directness. Forget about installations or server setups; everything happens right inside your browser, meaning your financial data never, ever leaves your computer.

Your first move is simply to get your prepared PDF or CSV file into the tool. Most let you just drag and drop the file onto the interface, or you can use the classic file-picker. Since the tool runs entirely client-side, the file isn't being "uploaded" in the traditional sense. Your browser is just opening it locally for processing.

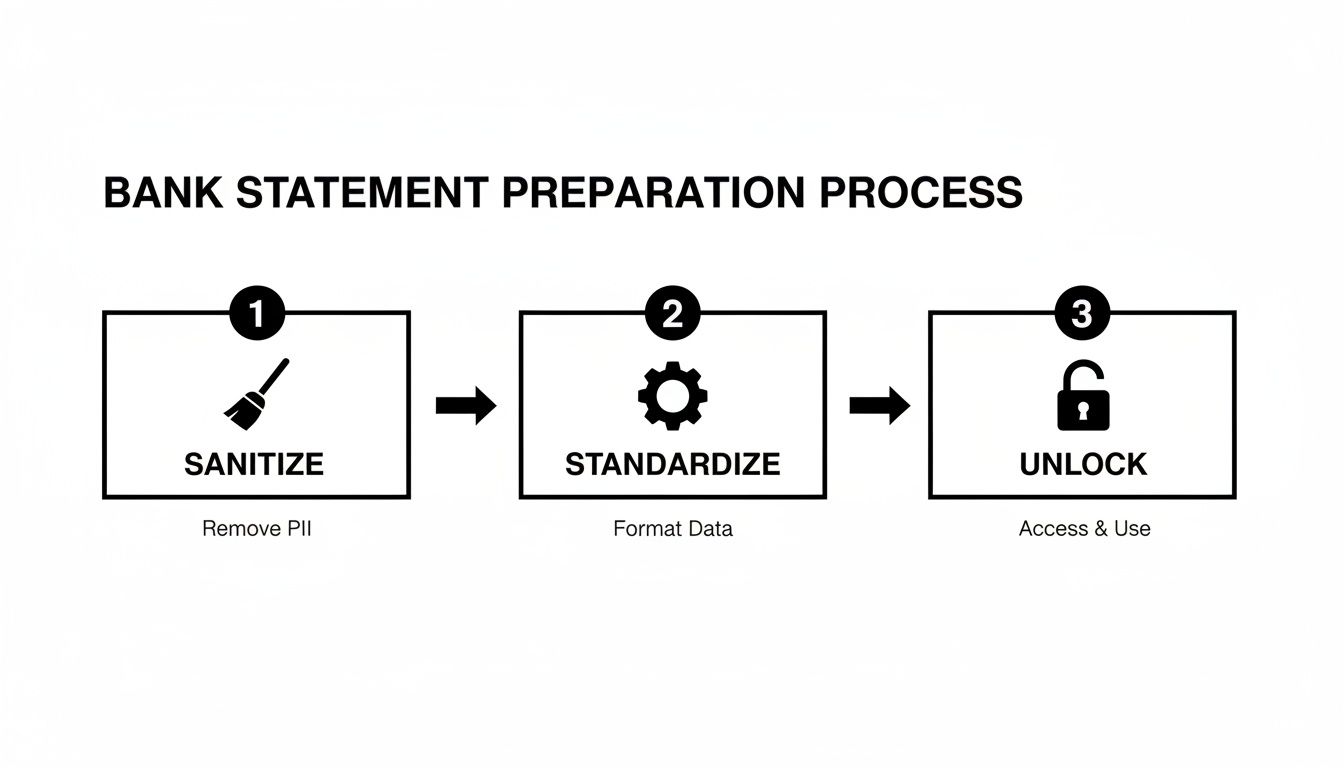

This diagram lays out the groundwork—the essential prep stages that ensure your data is clean and ready before you even start the conversion.

It’s all about a disciplined approach: sanitize, standardize, and unlock. Get this right, and the rest of the process is a breeze.

Mapping Your Data Fields for Perfect Output

As soon as your file is loaded, the parser kicks in and starts pulling out the raw transactional data. This is where you take the reins. The tool will show you the columns it found and give you a data preview, asking you to map them to standard financial fields.

Honestly, this mapping step is the most crucial part of the whole process. You’re telling the tool how to interpret your specific statement’s layout.

- Date: Point this to the column with the transaction date.

- Description/Payee: Link this to the transaction details column.

- Amount: Some statements have separate Debit and Credit columns, while others use a single Amount column with negative numbers for withdrawals. A good tool will handle both scenarios gracefully.

Here’s a real-world example: I often see statements where the description is a jumbled mess, like "ONLINE PAYMENT 1234 AMAZON MKTPLACE WA". Just mapping this to 'Description' isn't very helpful. A powerful converter will let you apply rules. You could set up a rule to find and extract "AMAZON" into a clean 'Payee' field. That simple transformation makes your final data infinitely more useful for analysis.

This is what deterministic control looks like. You set the rules, and you get predictable, accurate output every single time.

Validating and Exporting Your Structured Data

Once you’ve mapped the fields, the converter should show you a complete preview of the final, structured data. Take a moment here to validate everything. Scan the dates, payees, and amounts. Did the debits and credits land in the right place? Are all the dates formatted consistently?

Because this is all happening locally, you can tweak your mapping rules and re-process the file instantly. There’s no waiting. This workflow is a practical application of the core tenets found in https://www.DigitalToolpad.com/blog/software-development-security-best-practices, where data integrity and user control are non-negotiable.

When you’re happy with the preview, it’s time to export. You can choose the format that works for your project—CSV for spreadsheets, OFX or QIF for accounting software, or even JSON for custom applications. The download starts immediately.

And just like that, you’ve converted a highly sensitive financial document without it ever crossing the internet. To go deeper on maintaining data integrity and compliance, the principles discussed in guides on data governance in banking are incredibly relevant here.

Making the Converter Part of Your Workflow

Once you get the hang of converting single files, you can unlock the real value of an offline bank statement converter by weaving it into your larger data pipeline. This is where you graduate from one-off conversions to building a scalable, repeatable system for financial data. It’s less about the tool itself and more about making it a frictionless part of how you work.

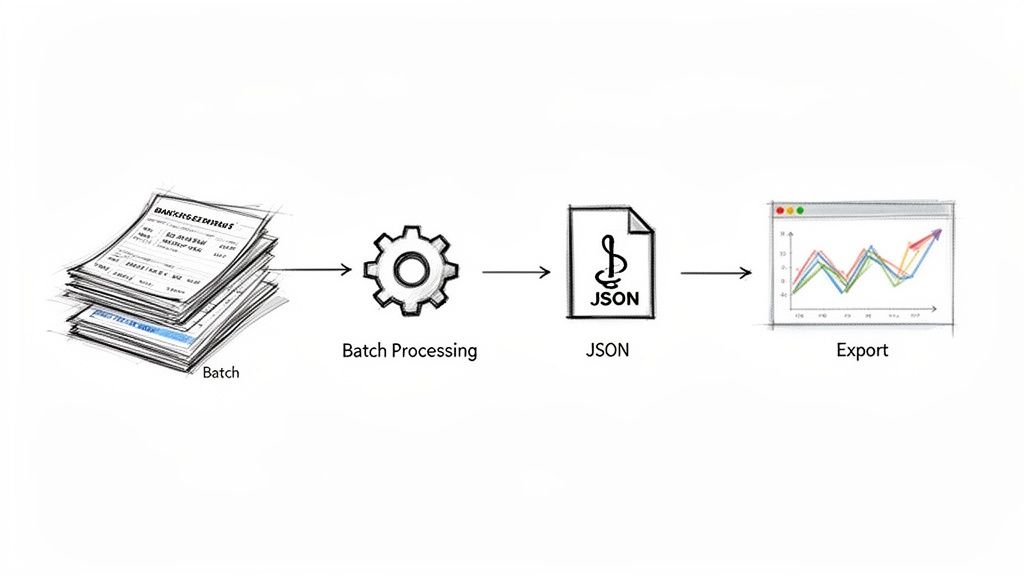

Stop thinking about one statement at a time. Picture a quarterly financial review where you need to pull together transactions from multiple accounts at several different banks. The old way—manually converting a dozen PDFs and trying to merge them—is a recipe for headaches and mistakes. This is exactly where batch processing changes everything.

With a solid offline tool, you can just point it to a folder full of statements. The converter will chew through them one by one, applying your saved rules to each file. What used to be a mountain of tedious work becomes a single, automated step.

Speed Things Up with Field Mapping Templates

The trick to making batch processing truly efficient is to use reusable field mapping templates. We've all seen it: every bank has its own unique way of formatting statements. One might call withdrawals "Debits," while another just uses negative numbers in a single "Amount" column. Instead of remapping these fields every single time, a good converter lets you save your settings as a template.

You could, for example, set up templates like these:

- "Chase Business Checking" Template: This one knows their specific date format, which column is the description, and how to handle separate debit/credit columns.

- "Amex Corporate Card" Template: This template is configured for their unique transaction details and single amount column with positive/negative values.

When you run a batch process, you just tell the converter which template to apply to which file. This is how you ensure every statement is parsed with 100% accuracy, no matter where it came from. You build these templates once and they save you time forever.

Scripting Your Exports for Custom Integrations

If you're a developer, the final piece of the puzzle is scripting the output to feed into an API or a custom dashboard. Most professional-grade offline converters let you export clean, structured data as JSON. This format is the lingua franca of modern applications and works with pretty much any programming language out there.

Think about building a custom analytics dashboard to monitor company spending. You could set up a process where you batch convert a month's statements, export everything to one consolidated JSON file, and then have a script automatically pick it up to refresh your charts.

This kind of automated pipeline elevates the converter from a simple utility to a core piece of your data infrastructure.

Here’s what that looks like in the real world:

- Collect the Files: Drop all your monthly PDF statements into a specific folder.

- Run the Batch: Load the entire folder into the converter, applying your saved mapping templates as you go.

- Quick Validation: Glance at the aggregated transaction preview to spot-check for any obvious errors.

- Export to JSON: Download the final, clean dataset as a single JSON file.

- Automate the Last Mile: A simple script (Python or Node.js work great for this) grabs the new JSON file, checks it, and pushes the data to your database or analytics API.

This whole sequence can be done in minutes. It turns what was once a half-day of mind-numbing data entry into a fast, error-free workflow. By mastering these more advanced techniques, the converter becomes an essential tool for anyone who needs to manage financial data securely and efficiently.

Troubleshooting Common Conversion Problems

Even the best bank statement converter is going to hit a wall now and then. Let's be honest, financial documents can be a mess of inconsistencies. The good news? Most conversion errors are predictable and, once you know what to look for, pretty simple to fix. So don't get frustrated—think of it as fine-tuning your data workflow.

By far, the most common culprit I run into is the scanned PDF. If your bank sends you what’s essentially just a picture of a paper statement, a standard text parser has nothing to grab onto. The converter will likely spit back an error or just give you empty fields because, from its perspective, there's no actual text data there to extract.

Dealing with Scanned PDFs and OCR

The solution for these image-based PDFs is to run them through Optical Character Recognition (OCR) before you even think about conversion. A good offline OCR tool can scan the image and turn it into a text-based document that your converter can actually read and process.

To get the best results from your OCR software:

- Start with a High-Quality Scan: Garbage in, garbage out. The clearer and higher-resolution your document is, the better. Blurry text is the number one reason OCR gets things wrong.

- Keep it Local: Just like with the main converter, stick to an offline OCR tool. This keeps your sensitive financial data off someone else's servers and under your control.

- Eyeball the Output: Before you feed the OCR'd file into the converter, give it a quick scan. Look for obvious mistakes, like the number "0" being mistaken for the letter "O." It only takes a minute.

Trust me, a quick check after the OCR step can save you a world of hurt later. I once burned twenty minutes trying to figure out why a balance was off, only to find the OCR had read an "8" as a "B."

Normalizing Messy Data Fields

Another headache you'll run into is messy, inconsistent data within the statement itself. A converter can only parse the information it's given, and sometimes that information is all over the place.

A classic example is a transaction description that spills onto multiple lines. You'll see the payee on one line and the location on the next, making it impossible to get a clean, single-line entry. A solid converter should have a feature to merge these multi-line descriptions into one field, so you don't lose the full context of the transaction.

You also need to keep an eye out for inconsistent currency symbols or number formats. If your statements sometimes use "$" and other times use "USD," or if they mix up decimal conventions, it can completely throw off your calculations. The fix is to use the converter’s normalization settings to standardize these fields as you map them. This ensures all your final data is clean, uniform, and ready to use.

Common Questions About Offline Converters

Even the most straightforward guides can leave a few questions unanswered, especially when you're handling sensitive financial data. Let's tackle some of the most common things people ask about using an offline converter. I want to give you the direct answers you need to be confident in your security and workflow.

Is an Offline Bank Statement Converter Genuinely Secure?

Yes, it is. When a converter is built to be truly offline and browser-based, all the processing happens right there on your computer. It’s a closed loop.

Your bank statements are never uploaded, sent across the internet, or peeked at by some third-party server. The conversion from PDF to CSV or another format happens entirely within your browser's own memory. Think of it as a temporary, secure workspace that vanishes when you close the tab.

This "local-first" method is exactly what you should look for when handling private information. It guarantees your financial data stays 100% private and completely under your control, which is a must for complying with regulations like GDPR and protecting your company's security.

What Formats Can I Get My Data Into?

A good offline tool won't lock you into a single format. You need flexibility, so look for a converter that can export to several standard formats that real professionals actually use.

You should expect to see options like:

- Structured CSV: The go-to for anyone working with spreadsheets. It’s perfect for pulling data into Excel or Google Sheets for deep analysis or financial modeling.

- JSON (JavaScript Object Notation): This one’s for the developers. It’s the ideal format if you're feeding the transaction data into custom applications, APIs, or internal dashboards.

- Financial Software Formats: Direct support for OFX or QIF is a huge time-saver. These are the formats you'll use to import transaction data straight into accounting software like QuickBooks or Xero.

Having these choices means the tool fits your workflow, whether you're just organizing transactions in a spreadsheet or building out a complex automated reporting system.

The ability to export to multiple, standardized formats is a non-negotiable feature. It ensures the converter isn't a dead-end but a bridge that connects your raw statements to the systems where that data becomes truly valuable.

Will It Work with Statements from My Bank?

In most cases, yes. The best offline converters don't rely on rigid, pre-built templates for specific banks. Instead, they're designed to parse the text and visual structure of the document itself. This makes them surprisingly adaptable and largely bank-agnostic.

The secret sauce here is the field mapping interface. This feature is what gives the tool its power. It lets you visually click on the columns in your statement—like 'Date', 'Transaction Details', or 'Withdrawal'—and match them to the converter's standard output fields.

Once you set it up for a particular bank's layout, you can save that mapping as a template. The next time you have a statement from that same bank, you just load the template and you're good to go. This makes the tool incredibly versatile for handling statements from just about any financial institution you might encounter.

Ready to convert your bank statements with total privacy and control? The Digital ToolPad suite offers a powerful, 100% offline bank statement converter that runs directly in your browser. No uploads, no servers, no risk. Find the right tool for your needs at Digital ToolPad.